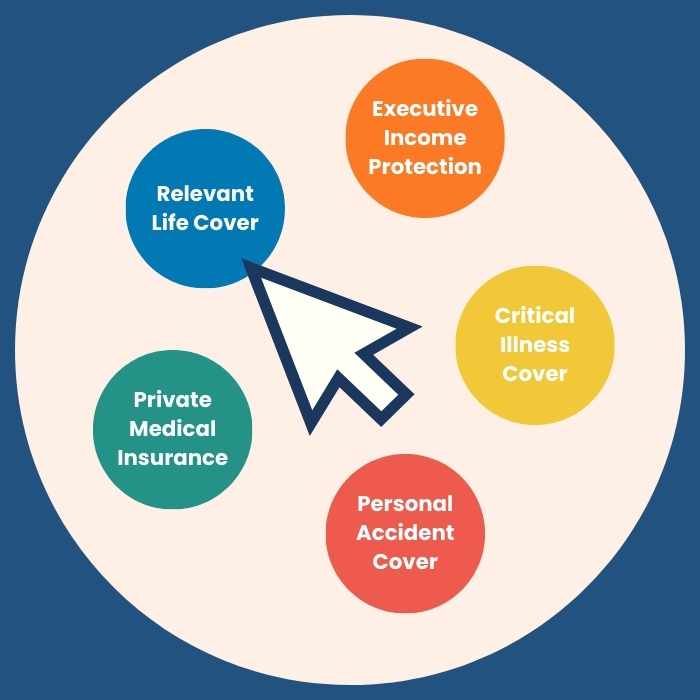

Relevant Life Cover:

Offer peace of mind to your loved ones. Sarah, a business owner, felt confident knowing her family and business were protected with coverage beyond what traditional life insurance offers.

Executive Income Protection:

Stay financially secure, even if you can't work. After an unexpected illness, Mike's Hug coverage replaced his income, allowing him to focus on recovery without financial worries.

Critical Illness Cover:

Prepare for the unexpected. When Maria was diagnosed with cancer, Hug's Critical Illness Cover helped her access the care she needed and supported her business in her absence.

Personal Accident Cover:

Protect your livelihood in case of accidents. Omar's cover ensured his business could continue without a hitch after he suffered a road traffic accident that meant he couldn't work for 3 months, covering his medical costs and recovery expenses.

Private Medical Insurance:

Access to fast, high-quality healthcare. Tom valued Hug's Private Medical Insurance for its quick access to medical care, keeping him healthy and available to lead his business.